One of the most common questions among new boat owners is that of insurance. Do I need a separate boat insurance policy, or is it okay to just list it on a rider under my existing home policy?

While a rider on your house insurance may be okay for a canoe, kayak or paddleboard, there are many reasons why any boats larger than that (and certainly anything with an engine) are better protected under a specific boat policy.

The biggest issue with home policies is that they simply aren’t written with the unique needs of boaters in mind. They never contain the specific language and wording that can make a huge difference in how a claim is handled, resulting in problems such as named perils clauses that will only cover loss or damage resulting from things specifically described in the policy. Because homes seldom face the type of exposure to damage that boats do, house policies don’t account for the types of problems boats might face, such as being involved in a collision while under tow, or hit by another boat that broke free of its slip in a storm. If that happens to your boat, and those specific perils aren’t named in the policy, you could be out of luck when you try to file a claim.

Another big concern with having a simple rider on a home policy is what insurers describe as depreciated claims settlements. What this means is that the insurance covers the actual cash value of the item – value that depreciates over time. So if you hit a rock and damage the engine on your three-year-old boat, your insurance may only be willing to replace the damaged engine parts with replacements that also have three years of wear and tear on them. Using new parts (as will almost certainly be the case, since used parts are virtually impossible to find) means you will have to pay the difference in value between the cost of the new parts and the depreciated value of the parts which were damaged. That could be a significant amount of money.

Similarly, riders on your home policy almost never provide for pollution. If your boat sinks and results in a fuel spill, you could be on the hook for an environmental cleanup that could run into the tens of thousands of dollars. By comparison, a proper boat policy normally covers things like spills.

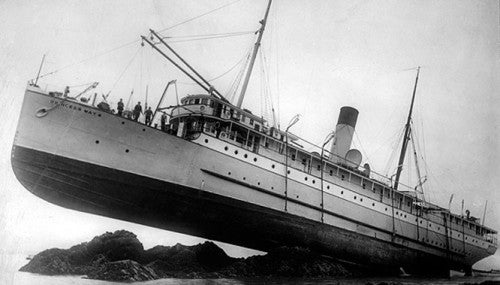

When shopping or boat insurance, it’s best to pay a small amount more and buy an all risk policy that provides full replacement cost for all repair parts and labor. Apart from covering the boat against all possible risks for damage and/or loss, a good boat policy will also include coverage for expenses like medical payments arising out of an incident with the boat, personal effects (to cover your things on the boat), coverage against damage you cause to other boats, emergency towing, pollution from an incident, and possibly even salvage and/or wreck removal fees (which can be considerable).

Some policies may even include coverage against loss of use. If you need to rent another boat while you wait for repairs to be completed to yours, or if it conks out far from home and you need a rental car, you’re covered.

Proper boat policies can protect against loss of use, allowing you to rent another boat while yours is being repaired.

Vermin coverage is another common clause in boat policies that’s almost never covered when you put the boat under your house policy. Ever seen what a family of raccoons can do to a boat?

The most important thing is to speak with your broker. Insurance coverage varies widely, so check to find out exactly what your own situation is. Better to ask now than to face an unpleasant surprise later.

Boating is fun. The best way to keep it stress-free by making sure your boat is protected by proper insurance coverage. Then you can enjoy the sunshine and fresh air knowing no matter what happens, someone has your back.

Fort Lauderdale International Boat Show Preview

Fort Lauderdale International Boat Show Preview 10 Best New Boat Accessories at IBEX 2021

10 Best New Boat Accessories at IBEX 2021 2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled

2022 Sea-Doo Switch Pontoon Boat Lineup Unveiled BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat

BRP Enters Fishing Boat Market with Purchase of Alumacraft Boat Volvo Commits To Electric Power By 2021

Volvo Commits To Electric Power By 2021 Kemimoto 4 Bow Bimini Top and Boat Bumper Review

Kemimoto 4 Bow Bimini Top and Boat Bumper Review Starweld Victory 20 Review

Starweld Victory 20 Review Princecraft Ventura 23 RL Review

Princecraft Ventura 23 RL Review Lund 2075 Pro V Review

Lund 2075 Pro V Review Scout 281 XSS Review

Scout 281 XSS Review Fuel Saving Tips For Boaters

Fuel Saving Tips For Boaters Best Boating Accessories

Best Boating Accessories Best Boating Apps

Best Boating Apps 5 Pontoon Boats That Are Made To Fish

5 Pontoon Boats That Are Made To Fish 10 Great Small Pontoons

10 Great Small Pontoons Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It?

Your Boat Was Expensive—Do You Really Trust a $2 Rope From the Dollar Store to Secure It? Do I Need Insurance Coverage Against Ice or Freezing Damage?

Do I Need Insurance Coverage Against Ice or Freezing Damage? What Kind Of Insurance Coverage Do I Need?

What Kind Of Insurance Coverage Do I Need? What About Salvage?

What About Salvage? Boat Insurance or Yacht Insurance?

Boat Insurance or Yacht Insurance? The Best Bowriders For The Money

The Best Bowriders For The Money

Sailfish 312CC Review

Sailfish 312CC Review

The Wildest Concept Yachts

The Wildest Concept Yachts

2016 Trifecta 200 Series 220FCR

2016 Trifecta 200 Series 220FCR 2016 Harris Grand Mariner SL 270 DL

2016 Harris Grand Mariner SL 270 DL 2016 Crestliner Authority 2050

2016 Crestliner Authority 2050 2016 Harris Grand Mariner SL 230 DLDH

2016 Harris Grand Mariner SL 230 DLDH